What Most People Get Wrong About BNPL

If you were to summarise most news coverage of the BNPL sector, it would basically round to “it’s making kids buy more stuff they don’t need and driving them into debt.”

Table of Contents

If you were to summarise most news coverage of the BNPL sector, it would basically round to “it’s making kids buy more stuff they don’t need and driving them into debt.” More specifically, the coverage usually invokes the tone of a worried parent warning you of the perils of easy debt, drugs, sex, and rock’n’roll. Ok, maybe not the drugs, sex, and rock’n’roll stuff, but definitely the debt bit.

However, this is far from the truth. In fact, the data suggests something else is sitting behind the meteoric rise of the BNPL sector.

Australia has been the epicentre of the BNPL industry. In fact, the ASX is home to some of the largest BNPL companies globally, and cumulatively the 7 listed entities are worth close to $35bn AUD — with Afterpay accounting for much of that.

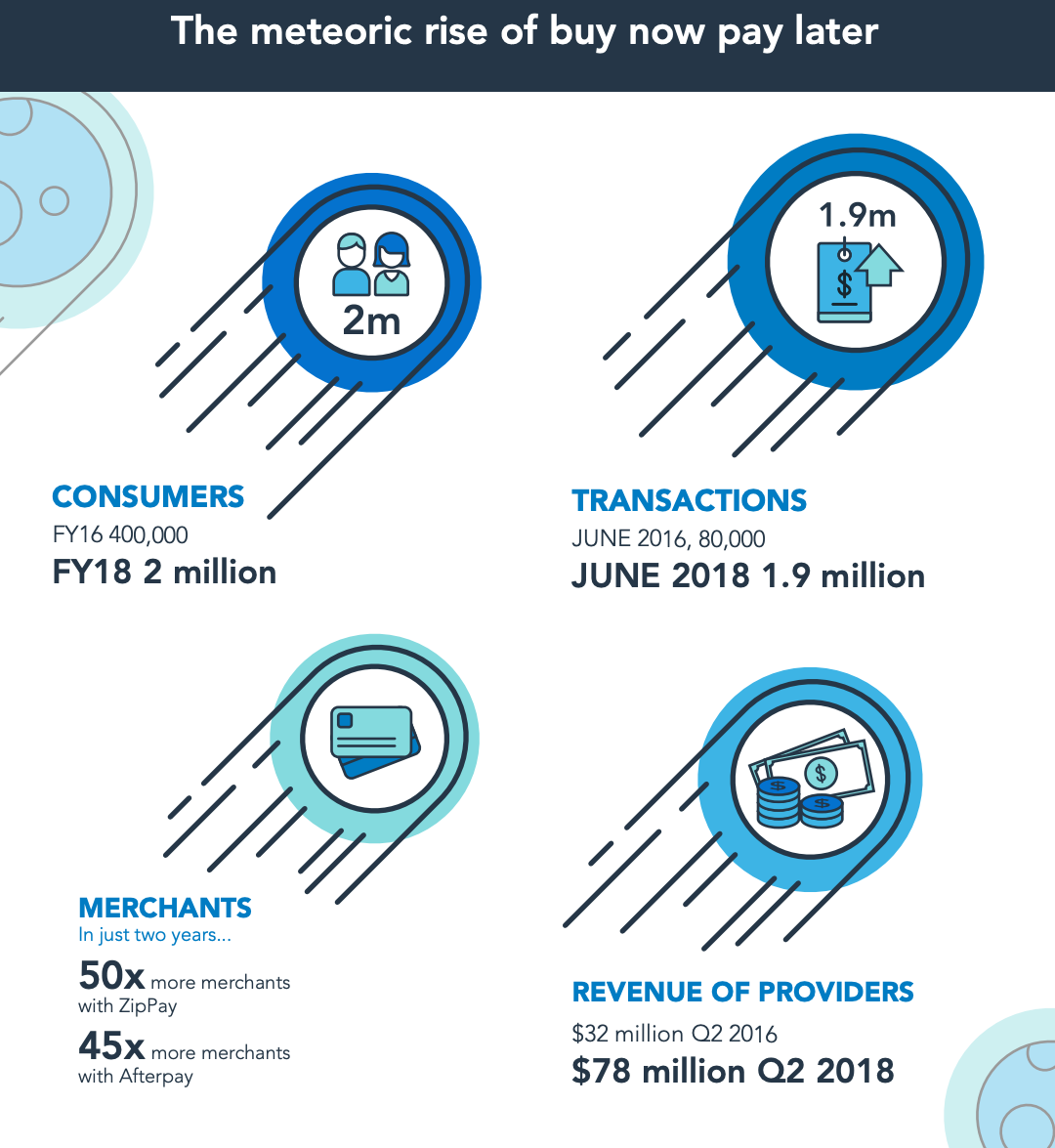

A recent report by the Australian Securities and Investments Commission (ASIC) sheds some light on just how big the sector has become in Australia. Here is a quick snapshot of the industry.

It’s worth pointing out that the sector grew 5x in terms of customers in just 2 years, and the number of merchants using a BNPL facility has increased by 45x for ZipPay and 50x for Afterpay. That’s some extraordinary growth.

So what’s driving the uptick in the use of BNPL?

According to the same ASIC report, it’s actually a lot less sinister than the easy credit narrative most would have you believe. In fact, the report notes that:

90% of users believed that buy now pay later arrangements allowed them to ‘manage spending by spreading payments over time’

More interestingly, most people tied repayments to a debit card or transaction account (74%) even though more than half had credit cards (51%). Further, 74% reported never missing a repayment, while the percentage of BNPL transactions that incurred a missed payment fee was only around 14% as of June 2018.

Although it’s a much more boring story, the data suggests that BNPL is a way Millennials and increasingly Gen-Z manage their money. If a credit card’s “job to be done” is the deferral of payment when you have the money, BNPL has basically done that in a more digitally native and convenient way.

As much as banks can’t wrap their heads around the fact that credit cards are dying, they are, and no amount of rebranding will change that. It’s much more conducive to clicks to say the industry is endangering the financial health of Gen-Z, but the real story here is how some Aussie companies (and a Swedish one too) disrupted the credit card industry by reinventing layaway payments.

Alan Tsen Newsletter

Join the newsletter to receive the latest updates in your inbox.